What is Challenged Most in EB-1C (Multinational Executives and Managers) Cases and Strategies and how to Avoid RFE (Request for Evidence) or Denial

We at Chen Immigration Law Associates constantly receive requests from companies and individuals regarding their qualifications to petition for the immigration category of EB1C Multinational Executives and Managers. We would like to take this chance to introduce this category and also discuss the mostly challenged requirements of EB1C and how to avoid getting RFE (Request for Evidence) or denial for this category.

What does the Law Say:

Statutory Language – 8 U.S.C. 1153(b)(1)(C)

An alien is described in this subparagraph if the alien, in the 3 years preceding the time of the alien’s application for classification and admission into the United States under this subparagraph, has been employed for at least 1 year by a firm or corporation or other legal entity or an affiliate or subsidiary thereof and the alien seeks to enter the United States in order to continue to render services to the same employer or to a subsidiary or affiliate thereof in a capacity that is managerial or executive.

Eligibility Criteria:

- You must have been employed outside the United States in the 3 years preceding the petition for at least 1 year by a firm or corporation and you must be seeking to enter the United States to continue service to that firm or organization.

- Your employment must have been outside the United States in a managerial or executive capacity and with the same employer, an affiliate, or a subsidiary of the employer.

- Your petitioning employer must be a U.S. employer. No labor certification is required but a job offer by the U.S. organization is required.

- Your petitioning employer must have been doing business for at least 1 year.

Reasons for Denying a Petition or Issuing an RFE (Request for Evidence)

In recent years, the two reasons most often cited by USCIS directors when denying EB-1C (Multinational Executives and Managers) petitions are (1) failure to demonstrate an ability to pay the proffered wage/salary to the beneficiary, and (2) failure to demonstrate that the beneficiary will be employed in a managerial or executive capacity.

1. Ability to Pay

USCIS directors will deny an EB-1C petition if the petitioner is unable to show that it is able to pay the wage or salary offered to the beneficiary.

A. Language of Law

8 C.F.R. 204.5(g)(2) states:

Any petition filed by or for an employment-based immigrant which requires an offer of employment must be accompanied by evidence that the prospective United States employer has the ability to pay the proffered wage. The petitioner must demonstrate this ability at the time the priority date is established and continuing until the beneficiary obtains lawful permanent residence. Evidence of this ability shall be either in the form of copies of annual reports, federal tax returns, or audited financial statements. In a case where the prospective United States employer employs 100 or more workers, the director may accept a statement from a financial officer of the organization which established the prospective employer’s ability to pay the proffered wage. In appropriate cases, additional evidence, such as profit/loss statements, bank account records, or personnel records, may be submitted by the petitioner or requested by the Service.

B. What is Required Evidence:

Required initial evidence must be in the form of copies of annual reports, federal tax returns, or audited financial statements. With this initial evidence, the USCIS director will to determine the petitioner’s ability to pay according to whether any of the following circumstances are satisfied:

- Net income – the initial evidence reflects that the petitioner’s net income is equal to or greater than the proffered wage.

- Net current assets – the initial evidence reflects that the petitioner’s net current assets are equal to or greater than the proffered wage.

- Employment of the beneficiary – the record contains credible verifiable evidence that the petitioner not only is employing the beneficiary but also has paid or currently is paying the proffered wage.

C. What Documents Can be Supplementary Evidence?

If any of these three circumstances are met, you are in a good position. However, if the required initial evidence does not establish ability to pay, the USCIS director may deny the petition since the petitioner has not met the burden to establish eligibility for the requested benefit. Unfortunately, net income and net current assets do not always accurately reflect the financial health of an organization so according to these calculations it may appear that the petitioner has not demonstrated an ability to pay. The use of additional financial information and different metrics may be able to demonstrate an ability to pay. The director does have discretion to consider additional financial information such as profit/loss statements, bank account records, or personnel records but may choose not to accept such information or different calculations. Despite this, it is wise to provide all financial information that may show ability to pay and to clearly explain how metrics other than net income and net current assets demonstrate this ability.

Other metrics that may be used to demonstrate ability to pay the proffered wage/salary include liquidity ratio measures such as current ratio analysis and the acid-test ratio. The petitioner should have its financial officers and accountants perform such calculations in order to show that the organization is able to pay the beneficiary. Statements from the petitioner’s financial officers clearly explaining the analysis and how it proves ability to pay should then be included with the EB-1C petition.

D. What does the Case Law Say?

There is also case law suggesting that an employer is allowed to show ability to pay if it has a reasonable expectation of future income. See Matter of Sonegawa, 12 I&N Dec. 612 (Reg. Comm’r 1967). In that case it was determined that the employer’s expectation of future financial profit was reasonable because the employer was able to show that it had been making a living and employing people without any evidence of financial difficulties, it incurred unusual expenses in the year of filing that temporarily worsened its financial situation, and it experienced a significant increase in income in the years subsequent to the filing of the petition. If the petitioner is able to show a reasonable expectation of future income, such that it will be able to pay the proffered wage/salary to the beneficiary, it may be argued that the director should find that the petitioner has demonstrated its ability to pay.

E. Conclusion for Ability to Pay

Finally, the petitioner may try to demonstrate an ability to pay with evidence that it has available cash that is sufficient to pay the proffered wage/salary. The EB-1C petition could include a clear explanation of the petitioner’s corporate tax structure and accounting methods and evidence that shows sources of ready cash that may be used to pay the beneficiary. The AAO has found that USCIS directors must consider the normal accounting practices of the petitioner even if the petitioner’s ability to pay is not reflected in their tax returns. See Matter of X, EAC 01-018-50413 (AAO Jan. 31, 2003) (Vermont Service Center), reported in 8 No. 18 Bender’s Immigr. Bull. 1528-29 (Sept. 15, 2003).

Ultimately the petitioner should try to convince the USCIS director adjudicating its EB-1C petition that a totality of the circumstances standard is appropriate rather than a reliance solely on net income, net current assets, or employment of the beneficiary a the means of demonstrating ability to pay. However, at the end of the day the director may choose to grant a petition only when one of these three circumstances is satisfied. Therefore, a strong effort should be made to satisfy one of the three circumstances at the initial evidence stage and not rely exclusively on additional financial information and different metrics to demonstrate ability to pay.

2. Executive or Managerial Capacity

USCIS directors are also apt to deny an EB-1C petition by finding that the beneficiary will not be employed in an executive or managerial capacity. The Immigration and Nationality Act offers specific definitions of “executive capacity” and “managerial capacity.”

Executive Capacity

- Language of Law

“Executive capacity” is defined in 8 U.S.C. §1101(a)(44)(B):

The term “executive capacity” means an assignment within an organization in which the employee primarily—

(i) directs the management of the organization or a major component or function of the organization;

(ii) establishes the goals and policies of the organization, component, or function;

(iii) exercises wide latitude in discretionary decision-making; and

(iv) receives only general supervision or direction from higher level executives, the board of directors, or stockholders of the organization

Managerial Capacity

- Language of Law

“Managerial capacity” is defined in 8 U.S.C. §1101(a)(44)(A):

The term ‘managerial capacity’ means an assignment within an organization in which the employee primarily—

(i) manages the organization, or a department, subdivision, function, or component of the organization;

(ii) supervises and controls the work of other supervisory, professional, or managerial employees, or manages an essential function within the organization, or a department or subdivision of the organization;

(iii) if another employee or other employees are directly supervised, has the authority to hire and fire or recommend those as well as other personnel actions (such as promotion and leave authorization) or, if no other employee is directly supervised, functions at a senior level within the organizational hierarchy or with respect to the function managed; and

(iv) exercises discretion over the day-to-day operations of the activity or function for which the employee has authority. A first-line supervisor is not considered to be acting in a managerial capacity merely by virtue of the supervisor’s supervisory duties unless the employees supervised are professional

Note that first line managers (individuals who work under the supervision of a middle manager and are responsible for managing the daily activities of a group of workers) are not considered to serve in a “managerial capacity” under this definition unless the employees they supervise are professionals. 8 U.S.C. §1101(a)(44)(A) (“A first-line supervisor is not considered to be acting in a managerial capacity merely by virtue of the supervisor’s supervisory duties unless the employees supervised are professional”). And even if the employees they supervise are professionals, the position must be primarily managerial. Q Data Consulting, Inc. v. INS, 293 F.Supp.2d 25 (D.D.C. 2003) (finding that, where the beneficiary’s former position as Senior Software Consultant was only 60-65% managerial and the beneficiary’s prospective position as Team Manager over 5-14 employees was not primarily managerial, there was no abuse of discretion in denying the petition even if INS subsequently granted an L-1A petition for the same position).

Note also that the definition of manager includes a beneficiary who manages a function of the organization. AFM at 22.2(i)(3)(E)(1). A function manager does not have to be in charge of any employees. Rather, he or she must manage an “essential function” or operation within the organization. 8 C.F.R. §204.5(j)(2). In Matter of X, LIN 07-060-50083, 2009 WL 1450548 (AAO Jan. 6, 2009) a petition was approved by AAO where a marketing director for a consumer electronics company had only one employee directly report to him and that employee in turn directed the work of three outside agencies. AAO found that a function manager does not have to oversee any employees but rather must manage an “essential function” or operation within the organization.

Proving Executive or Managerial Capacity

To prove that the beneficiary will serve in an executive or managerial capacity, the petitioner must do two things:

(1) show that the beneficiary performs the high level responsibilities that are specified in the definitions provided above; and

(2) show that the beneficiary primarily performs these specified responsibilities and does not spend a majority of his or her time on day-to-day functions. Champion World, Inc. v. INS, 940 F.2d 1533 (Table), 1991 WL 14470 (9th Cir. July 30, 1991).

The majority of the beneficiary’s duties must relate to operational or policy management, not to the supervision of low level employees, performance of the duties of another type of position, or other involvement in the operational activities of the company, such as doing sales work or operating machines or supervising those that do such activities. In Matter of Church Scientology International, 19 I&N Dec. 593 (Comm. 1988), it was noted, “An employee who primarily performs the tasks necessary to produce a product or to provide services is not considered to be employed in a managerial or executive capacity.” The decision also stated that “discretionary authority and a managerial or executive title . . . does not, in and of itself, mean a person is employed in a managerial or executive capacity.” Therefore, it is important to clearly specify the duties that the beneficiary will perform and to explain how these duties satisfy the definitions of executive and managerial capacity. It is also important to demonstrate that the petitioner will spend the majority of his or her time engaged in executive or managerial duties.

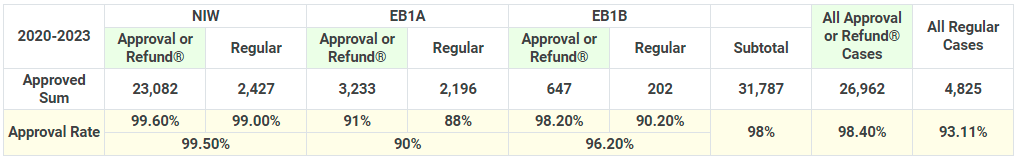

North America Immigration Law Group (Chen Immigration Law Associates) is a U.S. immigration law firm dedicated to representing corporations, research institutions, and individuals from all 50 U.S. states regarding I-140 immigration petitions. We specialize in employment-based immigration petition and have a proven record of high success rate for the categories of: EB2-NIW (National Interest Waiver), EB1-A (Alien of Extraordinary Ability), EB1-B (Outstanding Researcher/Professor) and O-1 (Alien of Extraordinary Ability).

Our Ten Thousand I-140 Approvals Provide Unprecedented Insight into the USCIS Adjudication Trend

With more than 58,000 EB-1A, EB-1B, EB-2 NIW and O-1 cases approved, we have first hand information on the manner in which the USCIS adjudicate I-140 cases. As the USCIS has constantly changed its adjudication standards for the EB-1A, EB-1B and EB-2 NIW categories, our firm's huge database of successful cases gives you unprecedented insight to USCIS adjudication trends. We carefully analyze the data for all of our cases and apply the results of our analyses toward giving our clients up-to-date advice and adapting our strategies such that we remain on par with the ever-shifting landscape of immigration law in the U.S. With us, you will always have access to important updates, strategies, and information so that you can make the most informed decisions about your case.

We Have Helped Hundreds and Thousands of Clients with Credentials and Backgrounds Similar to Yours

With our exceedingly large number of successful petitions, no matter what credentials you have, no matter your background and field of expertise, no matter your visa status or nationality, chances are we have helped hundreds or even thousands of clients just like you. Our clients are usually impressed with how well we understand their research and work. Our insight and understanding stems from the fact that we have handled many cases with elements similar to yours already, and this helps us devise the best strategies for each individual petition.

Vast Majority of Clients Came to Us Because of Referrals

For years, our firm has attracted new clients based solely on word of mouth, recommendations, and the positive collaboration experiences shared with them by their friends and family. We take pride in our reputation and work hard to ensure that we provide a green card application experience that our clients are happy to share with their friends and colleagues. That is how our cumulative total of approved cases grew from 600 in 2013 to over 58,000 in 2025.

Approval Notices: https://www.wegreened.com/eb1_niw_approvals

Success Stories: https://www.wegreened.com/blog/

Website: www.wegreened.com

Free evaluation: https://www.wegreened.com/Free-Evaluation

Tel: 888.666.0969 (Toll Free)

To see more clients’ testimonials and approvals, please refer to:

To Learn More About Your Options CLICK HERE

Copyright © North America Immigration Law Group – WeGreened.com, All Rights Reserved.